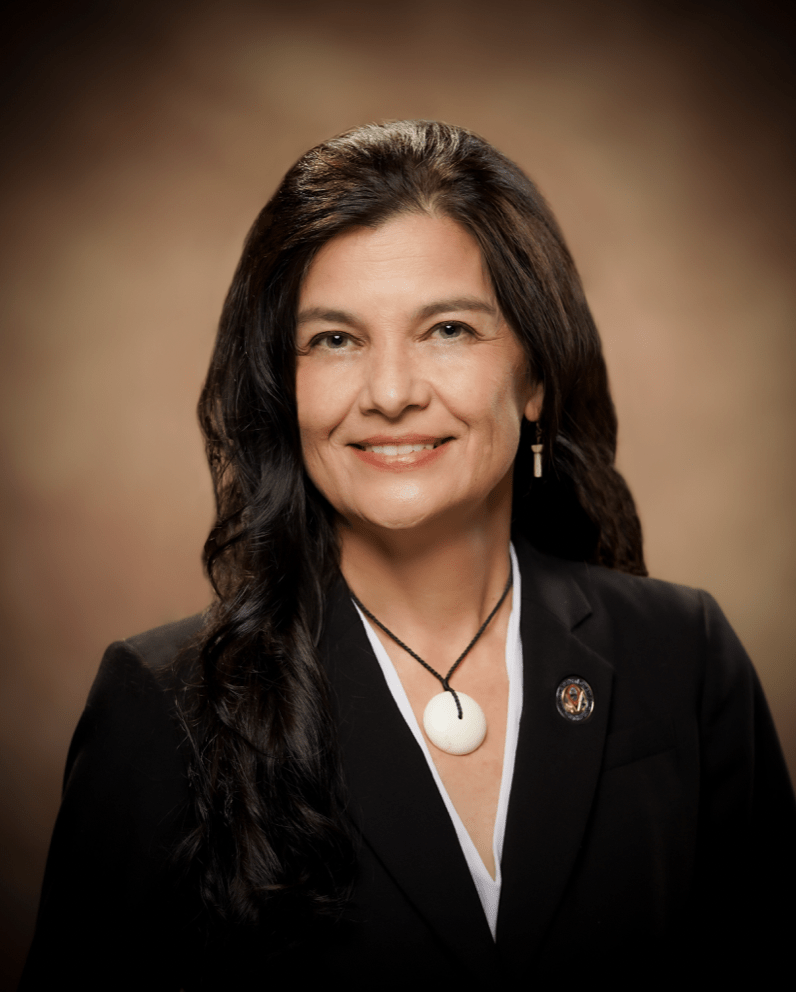

Speaker Therese Terlaje wants to get rid of fuel taxes so gas companies can have an incentive to reduce the high cost of gas drastically. The Leon Guerrero administration already is protesting the legislation she introduced to accomplish the price reduction. And, yet, the administration is failing to collect taxes from cigarette and alcohol distributors.

Ms. Terlaje is encouraging residents to speak in favor of her Bills No. 260 and 261 Thursday at 1:30 p.m. Bill No. 260 will eliminate a 4-cents increase to the gas tax implemented under a 2017 statute. Passage of Bill No. 261 will eliminate 23 cents per gallon (of regular gas) from the cost of gas by getting rid of the liquid fuel tax and its associated surcharges.

“Our residents are experiencing a dramatic increase to their cost of living on Guam due to uncertainty around the world and a slowly recovering economy,” the speaker said, adding that her bills are meant to help alleviate some of this burden. “These efforts are important in ensuring that our families who are struggling to pay rent and utilities are given sustainable financial support. I want to encourage our community to attend the public hearing this Thursday and to weigh in on these bills, especially if they want $0.15 per gallon cut from their final costs at the gas pump.”

According to a Pacific Daily News report by Joe Taitano, Bureau of Budget Management and Research director Lester Carlson, Jr., has criticized the measures for having a potential negative impact on the services the revenues from the liquid fuel tax funds.

Speaker Terlaje pointed out the latest consolidated revenues and expenditures report by the BBMR for GovGuam shows the government of Guam tracking a $62 million surplus. A fiscal note from BBMR on Terlaje’s tax cutting bills predicts GovGuam will lose about $10.5 million in revenue if the liquid fuel tax is abolished.

“I believe that with proper use of $62 million excess revenues, road repairs exceeding the current $10.5 million annually collected from the Liquid Fuels Tax can still be prioritized while bringing relief to struggling families and small businesses on Guam,” stated the speaker.

Meanwhile, cigarette & alcohol companies not paying taxes

While the administration bemoans cutting fuel taxes that will shortchange revenues by $10.5 million, a plethora of court documents and GovGuam financial reports indicate GovGuam is due much more than that amount in uncollected and even non-assessed sin taxes.

As reported extensively by Kandit, public audits that led to the reform of cigarette tax assessment statutes revealed the evasion of tens of millions of dollars in cigarette taxes annually.

Laws requiring the stamping of packs of cigarettes upon entry to Guam in order to properly count and assess taxes, and to outsource the administration of cigarette tax collection have been ignored.

Pleadings in lawsuits ongoing in the Superior Court of Guam allege several alcohol distributors are not paying the alcohol excise tax at all, with evidence presented in court that retailers are selling products for less than the price of the tax that’s supposed to be added to it.

A recent bankruptcy filing by alcohol distributor Titan Imports shows the company recently “discovered” and self reported alcohol excise tax liability of more than $2.5 million to the Guam Department of Revenue and Taxation for sales between 2015 and 2019. The company, according to the filing, offered DRT to settle the liability at a 75 percent discount for $600,000.