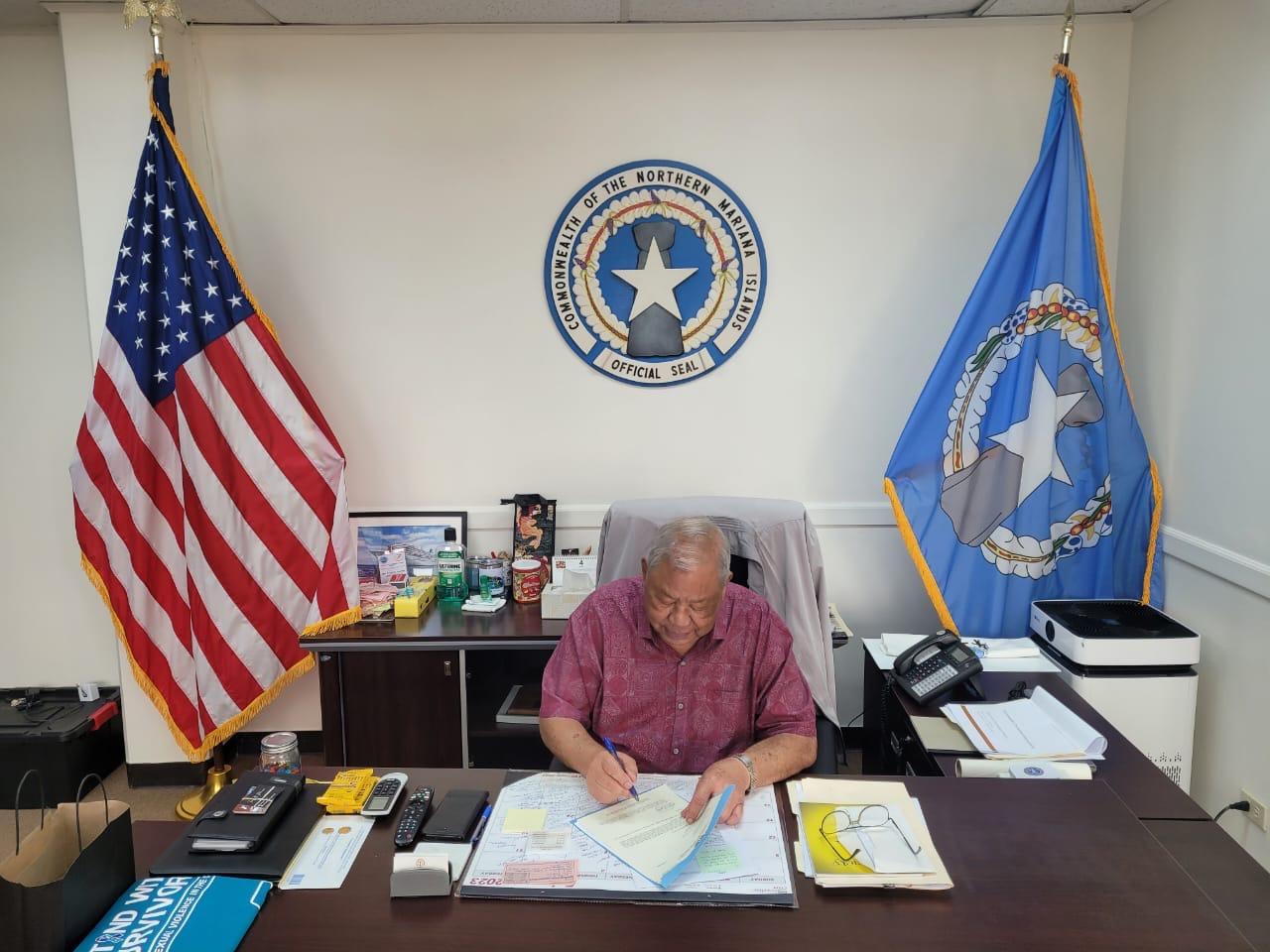

BREAKING NEWS: David Apatang, the acting governor of the CNMI, has signed Blas Jonathan Attao’s House Bill 23-104 into Public Law 23-18, appropriating $5.2 million from the Commonwealth Economic Development Authority to fund the 25 percent retiree pension supplemental through at least August 1.

Without the appropriation, the CNMI government would have had to halt payments for the rest of the fiscal year, starting April 15, just four days away.

“I am glad that the Legislature acted swiftly and decisively in passing legislation that would allow the continuation of the 25% pension payments to retirees,” said Governor Arnold I. Palacios, who left the CNMI to Guam just today to speak at a sustainability conference.

“Since the beginning of this administration, Lt. Governor Apatang and I have been committed to continuing the 25% pension payments to the retirees,” Mr. Palacios said. “We thank the House and Senate members for their work in expediting the passage of HB 23-104, which also demonstrates the Legislature’s efforts to ensure the financial security of many individuals who have dedicated their careers to public service.”

“As I’ve stated before, the leaders of the Commonwealth bear a collective obligation to safeguard our retirees’ benefits and give them the financial peace of mind they deserve,” Mr. Palacios added.

“The legislation sends a clear message to our retirees: we value your service, and we will continue to work together to protect our retirees’ livelihoods,” the governor said.

In a news conference earlier this week, Mr. Palacios said his administration is considering a pension bond that will relieve between $500,000 to $900,000 in weekly cash obligations to the retirement settlement fund. Such cash flow will have a significant positive impact on government operations, which can mean the end of the so-called austerity Mondays.