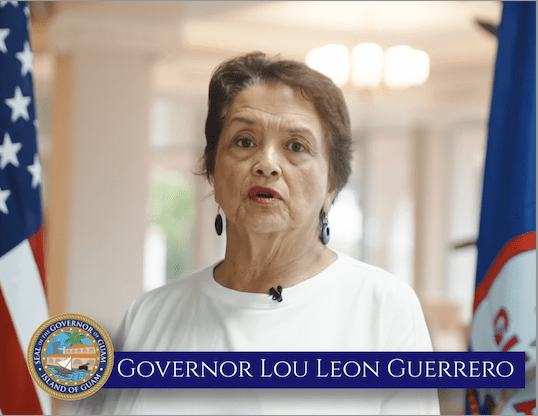

The Office of the Attorney General of Guam is investigating administration officials for the government of Guam’s use of Bank of Guam. The bank is owned by the governor and her family.

“Please take NOTICE that the Office of the Attorney General has received information that violations of Guam civil and criminal laws may have occurred by certain government of Guam officials,” Attorney General Douglas Moylan wrote to director of administration Edward Birn and treasurer of Guam Rosita Fejeran last week. “We understand that Department of Administration officials may have violated Guam law by not procuring financial services, as required by law, to the detriment of the People of Guam. The matter is under active investigation.”

DOA handles the government’s transactions with the government’s banking services vendor, Bank of Guam. About $1 billion in local and federal money are transacted between GovGuam and Bank of Guam on normal years. During the pandemic, however, when billions more in federal funds were provided to GovGuam, that amount increased significantly.

The first legal issue at hand, according to Mr. Moylan, is that for the past three fiscal years, GovGuam has allegedly been utilizing the governor’s family’s bank without any authority to do so.

“According to our information we understand that the last contract for Banking Services was solicited under former Governor Eddie B. Calvo’s administration to run from October 1, 2017 through September 30, 2020, and was extended for one year to September 30, 2021,” Mr. Moylan wrote to Mr. Birn and Ms. Fejeran. “We understand that under this Governor’s administration, that no competitive procurement was conducted thereafter, and that the Bank of Guam appears to have been allowed to conduct exclusive Banking Services on behalf of our client, and your employer, the People of Guam / Government of Guam.”

The period since that extension overlaps the period when Lou Leon Guerrero’s administration received $553 million in federal discretionary funds. At the time, the governor chose to stash away about $300 million to make a future down payment on a new hospital. That amount has since decreased by a few million. The amount was transferred into a custody account with Bank of Guam, according to documents filed with the Federal Financial Institutions Examination Council (FFIEC).

The period since that extension overlaps the period when Lou Leon Guerrero’s administration received $553 million in federal discretionary funds. At the time, the governor chose to stash away about $300 million to make a future down payment on a new hospital. That amount has since decreased by a few million. The amount was transferred into a custody account with Bank of Guam, according to documents filed with the Federal Financial Institutions Examination Council (FFIEC).

Lester Carlson, Jr. the governor’s budget director, told Kandit in an October 2022 interview that the money in that account was not accumulating to the benefit of the bank. However, those same FFIEC quarterly reports by Bank of Guam show similar transaction amounts between the so-called custody account and funds the bank moved into the Federal Reserve.

At the time Mr. Carlson confirmed that the governor’s bank was not using the federal ARPA funds to make money, the difference in the balances between the two accounts indeed was around $300 million, the amount the administration was saving in the bank to help build a new hospital. The Bank of Guam FFIEC filings for December 31, 2021, March 30, 2022, and the latest filing on record – June 30, 2022, confirm Mr. Carlson was telling the truth.

In fact, the government’s director of administration, Ed Birn, confirmed that while the bank – at least for this period in question – did not make interest from the Federal Reserve on federal ARPA deposits, the government of Guam did make interest from the bank. “We have accumulated some interest,” Mr. Birn confirmed, “about $300,000 that goes back to the ARPA account.”

But that’s not where this story ends.

On June 30, 2022, the Bank of Guam had more than $584,591,000 in the custody account, and $286,331,000 parked in the Federal Reserve, according to its FFIEC report. That’s a difference of nearly $300 million, which jives with the administration’s claim, at least for that report.

On March 30, 2022, the Bank of Guam had more than $744,118,000 in the custody account, and $404,778,000 parked in the Federal Reserve, according to its FFIEC report. That’s a difference of nearly $340 million, which jives with the administration’s claim, at least for that report.

On December 31, 2021, the Bank of Guam had more than $808,120,000 in the custody account, and $518,871,000 parked in the Federal Reserve, according to its FFIEC report. That’s a difference of nearly $290 million, which is close to the administration’s claim, at least for that report.

But…

For the two reports prior to that, the numbers tell a different story.

On September 30, 2021, the Bank of Guam reported in its FFIEC filing for that quarter, that more than $724,183,000 was in its custody account, and even more was deposited with the Federal Reserve, more than $763,756,000, suggesting that the government’s federal ARPA balance may have been making money for the bank.

The quarterly filing before that – June 30, 2021, shows a similar situation, with more than $795,153,000 in the custody account, and more than $751,111,000 parked in the Federal Reserve.

There is nothing illegal about this practice. The question is whether the governor or any of her representatives from the government had anything to do with decisions on where to place federal money in a bank, where she and her family have the controlling interest.

On May 21, 2021, the government of Guam received $553 million in federal discretionary funds resulting from the American Rescue Plan Act. Forty days later, on June 30, 2021, Bank of Guam’s FFIEC filing shows a deposit into the Federal Reserve of more than $751,111,000 – a nearly $500 million increase into that account from the previous report of $277,205,000 on March 31, 2021.

So, did the Bank of Guam make money off these deposits?

“It should not be in the lendable category,” Mr. Birn said in a 2022 interview with Kandit, adding that the Leon Guerrero administration has been clear with the bank that it should not place the federal funds in an account that would allow the bank to make money off of loan interest. He said the postings in those two quarters could simply be a reporting error, and that he would need time to verify such.

“I did do the due diligence,” Mr. Birn said of the Leon Guerrero administration’s efforts to prevent any impropriety or even appearance of impropriety. “If this money is in a trust account, it is with a third party.”

According to bank filings with the U.S. Securities and Exchange Commission, Gov. Lou Leon Guerrero and her family own 60 percent of the shares of the bank, with more than 41 percent under the control of the governor herself; control that temporarily is on hiatus while she is the governor. Prior to her assumption of office in January 2019, the governor placed her portion of shares in a trust, which she legally cannot steer while she is the governor. A portion of those shares belong to her husband in joint tenancy.

We asked the governor’s office for verbal confirmation that neither the governor, the first gentleman, the lieutenant governor, nor any member of her cabinet or staff has ever advised, instructed, or otherwise requested the Bank of Guam to place federal pandemic funds in accounts (ie the Federal Reserve) that would allow the bank the opportunity to make money either through interest income or through lending income. The governor’s office directed the question to Mr. Birn.

He responded to Kandit in writing:

“Department of Administration is responsible for carrying out Treasury activities for the Government of Guam as provided under the laws and regulations of the Territory of Guam. We pride ourselves on fair, ethical, transparent and fiscally sound management of Guam’s finances and prudent deposits of funds.

“Department of Administration has full responsibility for decision making and ensuring where and how ARPA or other federal fund advances are managed. To be clear, no one had given instructions to DOA as to where or how ARPA or any federal fund advance should be invested. DOA followed the law and invested in a fund, which in turn invests in federal obligations – this is considered a safe investment. This investment also provides our government with additional interest revenue that is rolled back into the ARPA fund for program use. DOA is concerned only that capital invested is secure and the resultant income is as high as such a risk-free investment will allow.

“The fund investment in question is not invested in Bank of Guam and therefore is not collateralized as a public deposit. Within five days of the receipt of the federal funding, a decision was made to move funds to this investment which is an independent and risk- free security because of the nature of the underlying fund, US Government federal obligations.”

The bank’s income numbers, while impossible to discern from the reports themselves the actual source of income, do show that the bank made money. The quarter following the September 30, 2021 report is when the bank posted its highest total interest income since the pandemic started: more than $82 million. This is the same period the bank posted its highest amount of total equity throughout the pandemic: More than $183 million.

This also was the same period the bank was a whisper away from $3 billion in total assets, or three times GovGuam’s General Fund and nearly all of the island’s entire gross domestic product.

And this was also the same period the bank paid out the greatest amount of dividends to its stockholders, and highest earnings.

Kandit asked Bank of Guam whether the governor or her husband have ever influenced decisions at the Bank of Guam since January 2019. We also asked whether they, or any person from the governor’s cabinet or staff have ever influenced bank decisions on where to place deposits of federal money. The bank never responded to Kandit’s inquiry.

“The question about whether government officials employed by the Government of Guam, specifically within your Department, including potentially yourselves, violated the law are of utmost importance given the amount of money that our client, the People of Guam / Government of Guam may have lost from allegedly not having competitively procured this large Banking Services procurement,” Mr. Moylan wrote in his letter last week to Mr. Birn and Ms. Fejeran. “The question about how to immediately stop the allegedly unlawful Banking Services is now at issue, the potential loss to the Government of Guam / People of Guam, and/or immediately starting the competitive procurement for Government Banking Services.”

8 Comments

Juanit

01/29/2024 at 9:12 PM

Finally. I’ve always wondered about that, but not in a position to ask. KANDIT, you’re number 1.

Frenchie

01/30/2024 at 3:29 AM

Thank you for a concise report. One of the main reason these kinds of dubious, unethical, and /or illegal issues is constantly plaguing the Leon Guerrero / Tenorio administration is its complexity, and murky nature. Your capacity to explain it as plainly as possible is a service to this community

Troy Torres

01/30/2024 at 9:23 AM

Thanks!

Alan San Nicolas

01/30/2024 at 6:36 AM

Huegon politika, ma imbestiga pago, agupa pues gi agupa ña man trankilu. MANANA I TANO AFAÑELOS.

Juan Malimanga

01/30/2024 at 11:10 AM

Guam is so corrupt! I’m so glad I don’t live there. The politicians of Guam are all greedy and corrupt. The entire government runs on nepotism. Just like GMH! Raymond [censored] is a real POS! He tried to extort me after doing surgery on my father. I complained to GMH about it and all they did was write me a letter saying they’re sorry this happened. LMFAO! Really?!! Meanwhile I’m sure that the sorry excuse for a man Raymond [censored] was continuing to extort the elderly.

B86!

01/30/2024 at 2:22 PM

Finally, something is being done. Thank you Kandit, and Attorney General Douglas Moylan. This Govenor thinks she so smart and untouchable.

frank camacho

01/31/2024 at 12:33 PM

Senators need to introduce a bill that prevents future relationship between the incoming governor and where GOVGUAM places its money. Big conflict of interest that only invites possible temptation and corruption opportunities. Sad to see our politicians didn’t see this coming. Governor and the Bank of Guam will be cleared of any wrongdoing and that their actions are all legal.

Imelda Tanapino

02/02/2024 at 4:12 PM

All of those words, photocopies, rambling legalese, scam-talk, etc, etc, simply to prove what everyone knows: GovGuam is corrupt.

Someone needs to set up a non-GovGuam moderated poll/election with actual consequences:

Is GovGuam corrupt?

1. Yes

2. No

Those who vote “No” in their paree-pareeism, greed, and selfishness should only be allowed health care at GovGuam’s biggest nepostic scam, Guam Memorial Hospital.