The Bank of Saipan is at the center of a legislative corruption investigation into the misuse of federal funds. The administration of lame duck Gov. Ralph Torres chose the non-federally-insured bank as the administrator of the Building Optimism and Opportunities for Stability Together (BOOST) grant program.

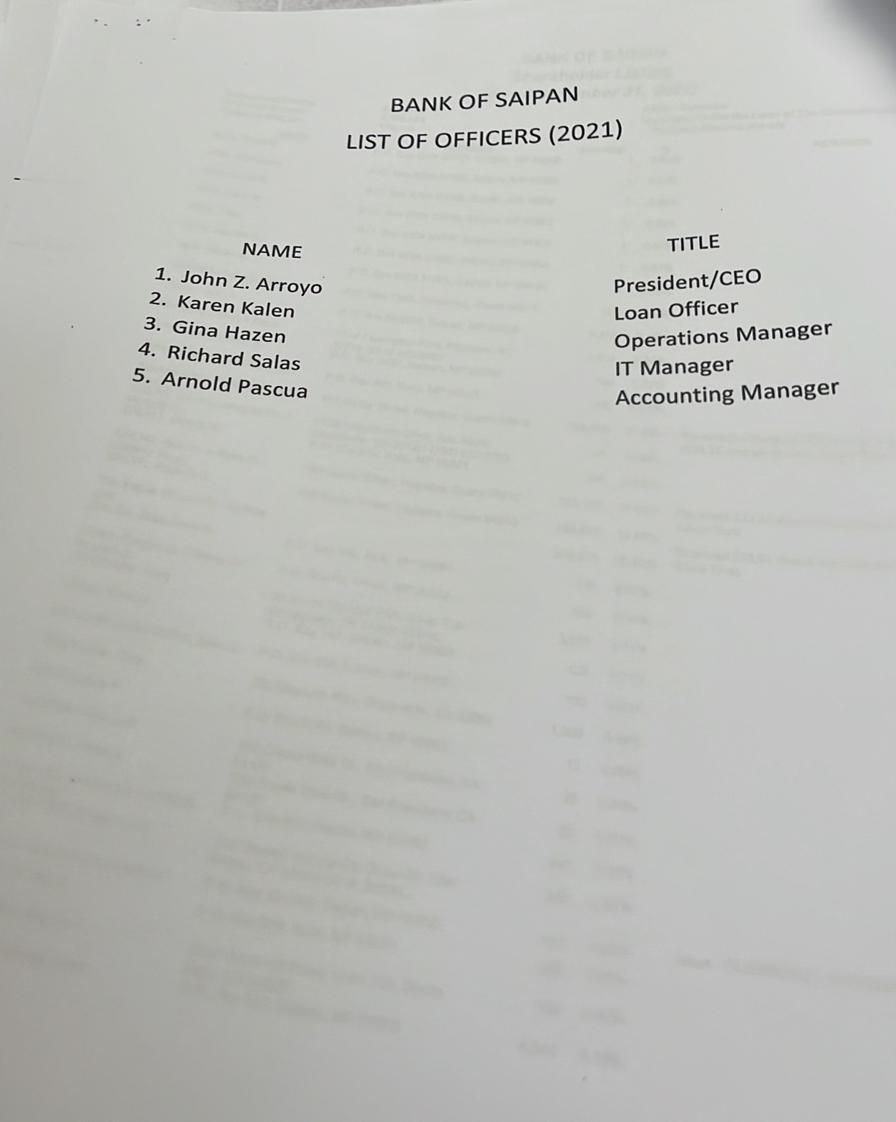

Its president, Guam banker John Arroyo, has been on the hot seat before a joint investigative committee of the CNMI House of Representatives for the past two days answering a barrage of questions. While the full breadth of the bank’s alleged involvement in any conspiracy has yet to be revealed, some facts already are stunning:

- The bank has made hundreds of thousands of dollars in both grants and fees paid to the bank from the program

- At least one of the bank’s officers and two others directly employed or associated with the bank received grants

- A subcontractor of the marketing company paid by the bank using federal funds is owned by the bank’s president’s sister

- The bank was visited by several agents with the Federal Bureau of Investigation Monday morning. Mr. Arroyo, under oath, told the investigative committee agents were there to serve a subpoena. He said he could not disclose further details.

Who owns the Bank of Saipan? That’s a question Rep. Corina Magofna asked Mr. Arroyo Tuesday afternoon.

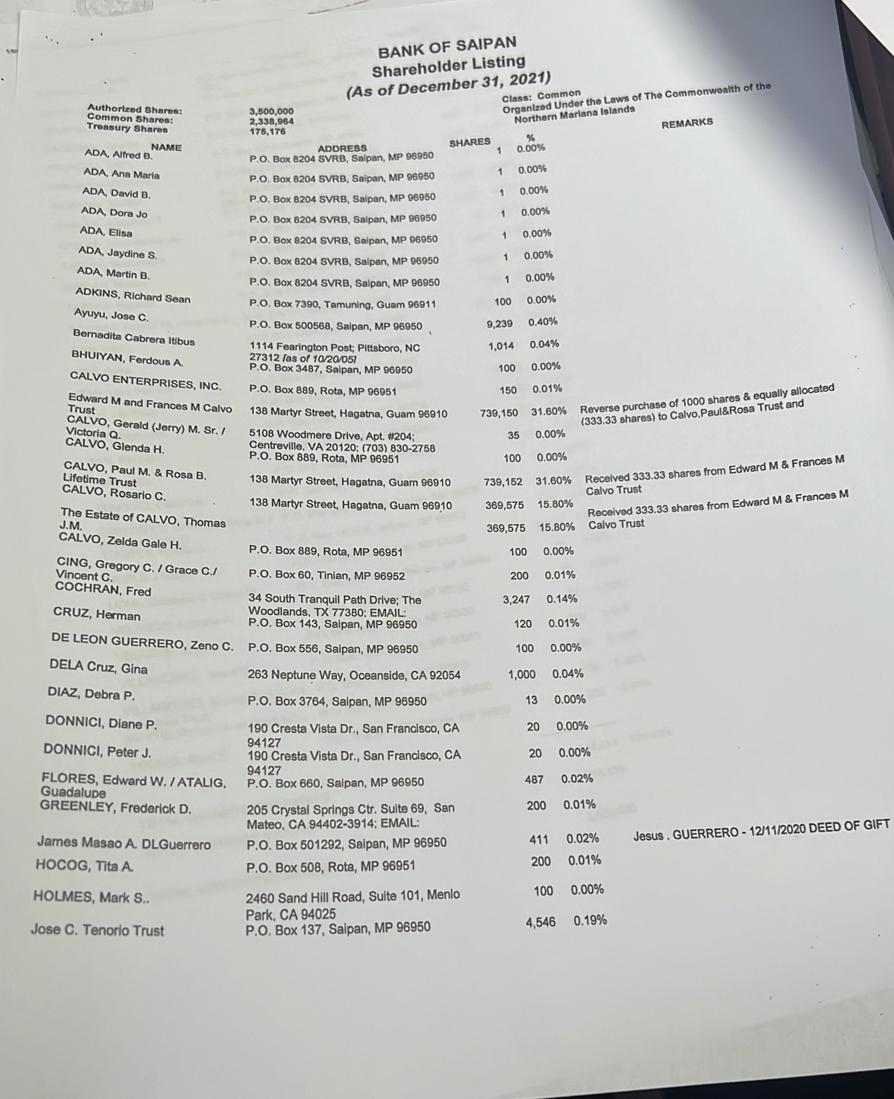

“The Calvo family,” Mr. Arroyo said. “Well, primarily two of the Calvo families own more than 90 percent of the bank.”

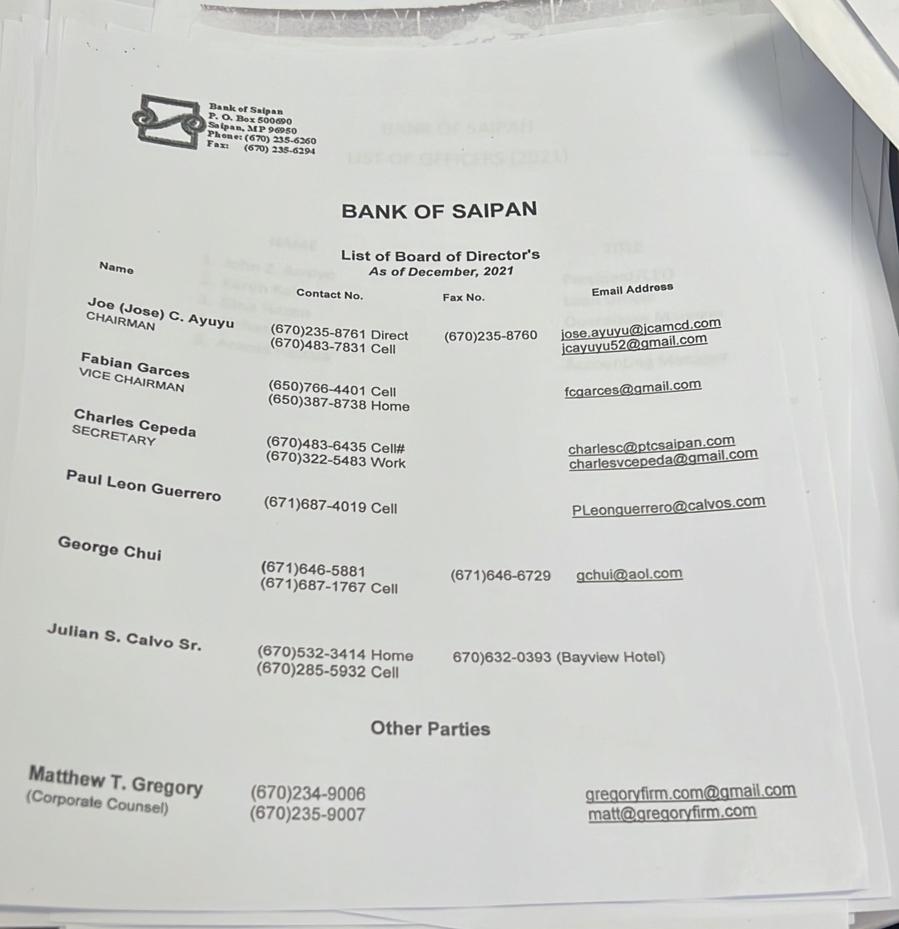

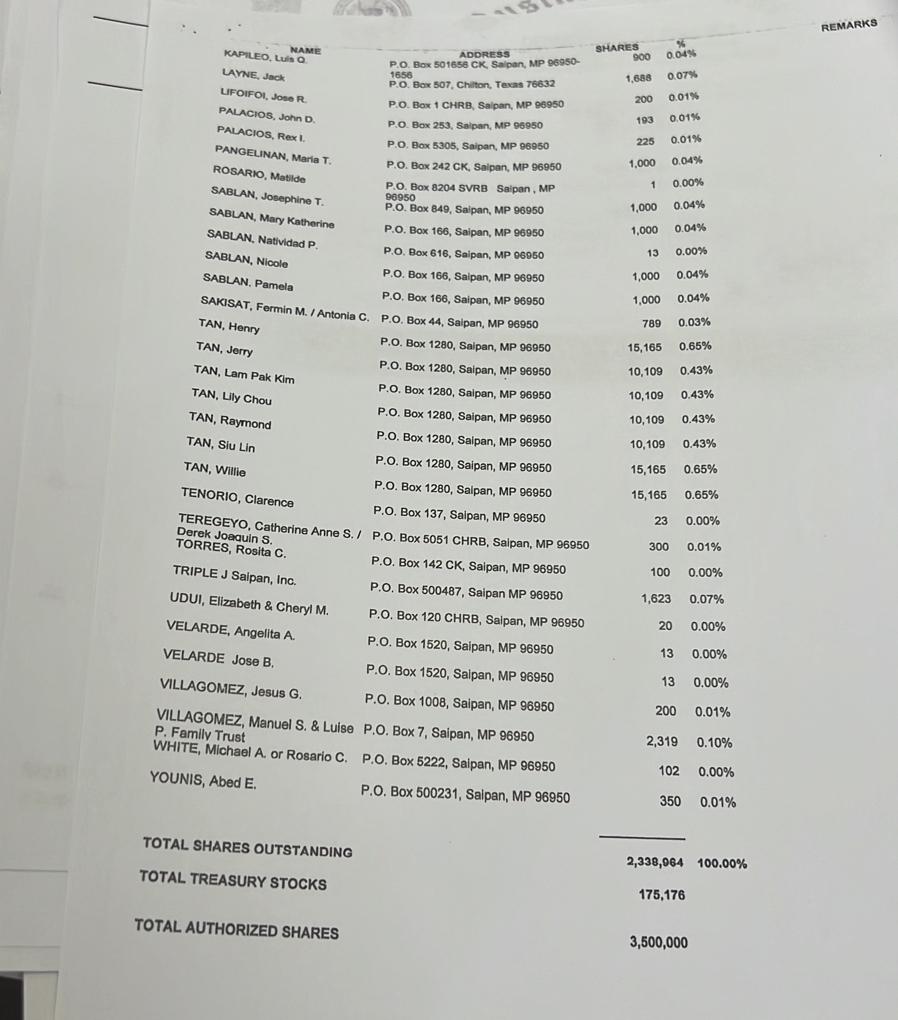

According to records Kandit obtained from the Commonwealth government, it is the Calvo family from Guam that indeed owns almost all the shares of the bank. The documents form Bank of Saipan’s annual corporate ownership disclosures for 2021. The 2022 disclosures are not due for filing until March 2023.

You may view photos of these filings below:

4 Comments

Mabel Doge Luhan

12/20/2022 at 4:56 PM

The FBI was just looking for the 24 hour ATM vestibule.

Joe

12/21/2022 at 7:42 AM

Mr. Troy Torres, can you please do the CNMI a favor and round up these bad people from Guam and bring them home? CNMI needs you and not these lousy bastards!

Secret Sauce

12/22/2022 at 9:36 AM

What’s the deal with Bank of Guam “going private” and cutting out small time share holders?

Rol Mondo

12/30/2022 at 3:01 PM

If private, perhaps they are not subject to regulation by federal agencies & therefore federal laws. However, they are designated to administer federal funds.