A Guam attorney who has been fighting a battle for her clergy sex abuse clients may have set the stage for a U.S. Supreme Court decision that may unlock billions of dollars in payments to more than 82,000 survivors throughout the country. The decision – or pair of decisions – also is the most highly anticipated in decades regarding bankruptcy in the United States, and may redefine the implementation of the federal bankruptcy code.

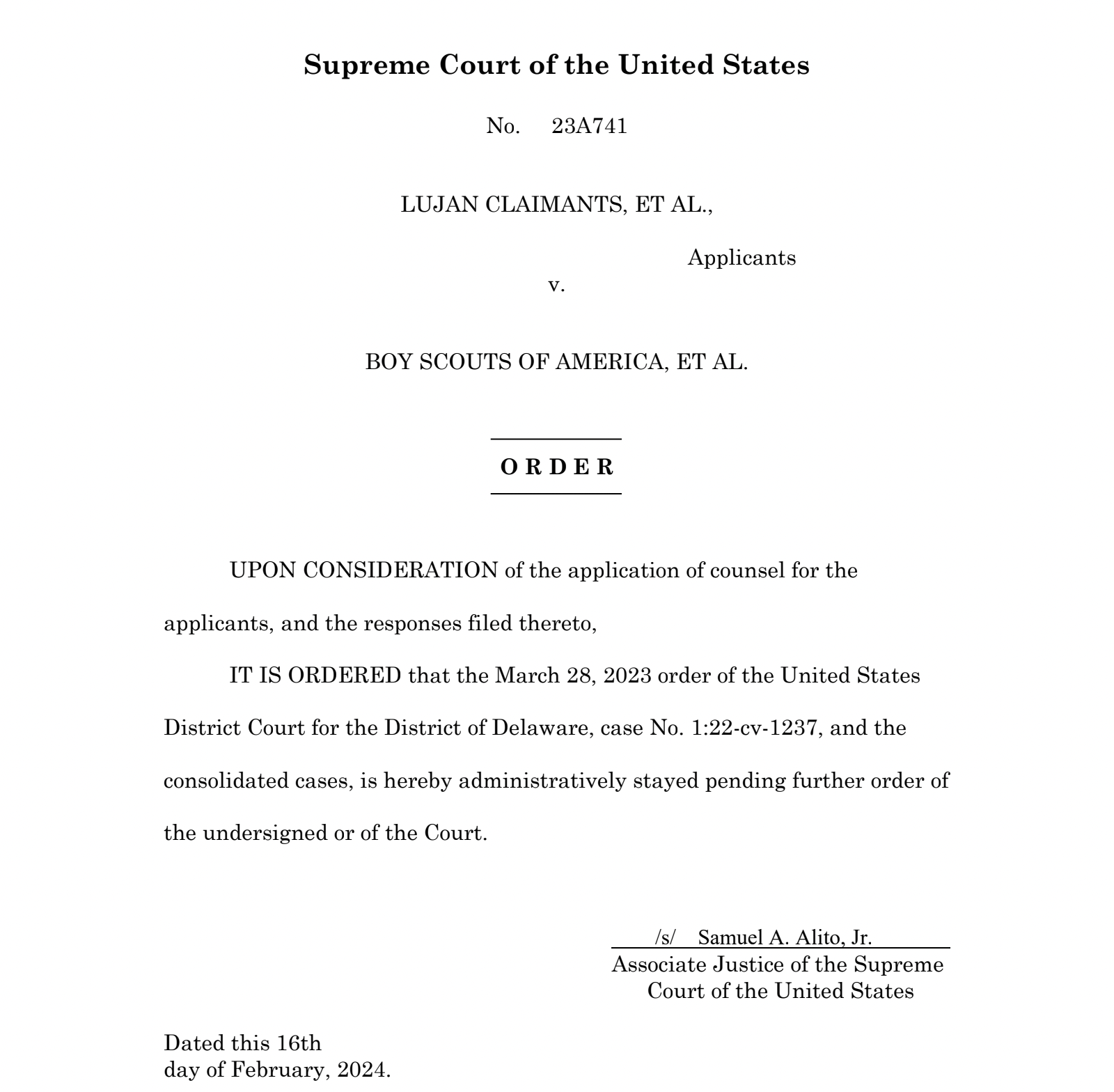

More than 100,000 organizations with liability linked to the Boy Scouts of America’s alleged cover up of clergy and BSA sex abuse would be immune from lawsuits if a Delaware federal bankruptcy court settlement is allowed to move forward. That settlement has been halted – incredibly, after payments have already been made – by the U.S. Supreme Court. In an astonishing, exceedingly rare decision by the court, Associate Justice Samuel Alito granted the stay proposed by Guam attorney Delia Lujan Wolff, who represents 75 of 144 U.S. child sex abuse victim claimants who have been fighting since 2022 against the Delaware court’s decision affecting all 82,000 victims of alleged BSA coverup throughout the country.

The move may also be unprecedented. While the court has stayed settlements in the past, such as the bankruptcy settlement case involving Purdue Pharma, Kandit has been unable to find a case the court has stayed that involved a settlement already in motion. The Purdue case and the Lujan case (reference made to Ms. Wolff and her father who began Guam’s historic litigation against clergy sex abuse and cover up – attorney David Lujan) are strikingly similar, with both settlements on appeal, and both proposing that U.S. bankruptcy courts have no authority under federal bankruptcy laws to declare parties not involved in a given bankruptcy case immune for liability to the bankruptcy applicant’s (called a debtor) creditors, according to both cases.

For example, in the Guam clergy sex abuse case, one of the debtors was the Archdiocese of Agana. Other debtors included the insurance companies that were on the hook to make payments to creditors (the claimant victims), and other organizations linked to the cover up of the same crimes, such as the Sisters of Mercy of the Americas, the Boy Scouts of America, etc. The archdiocese filed for bankruptcy following the lawsuits against it. Among the procedures of the bankruptcy was a full search and disclosure of the archdiocese’s assets. A willful failure to disclose any assets could result in criminal prosecution for the offender. A group of people assigned to represent the creditors – lawsuit claimants, banks, etc. – negotiated with the archdiocese’s lawyers to come up with a settlement plan that the U.S. District Court of Guam eventually approved. In order for a claimant to receive a payment from that plan, the claimant had to release the archdiocese from further claims based on the clergy abuse. The settlement plan was based on the bankruptcy of the archdiocese, the assets of the archdiocese that that bankruptcy proceeding discovered, and the distribution of those assets. In other words, the settlement did not release other debtors like BSA and the Sisters of Mercy from claims.

The lawsuits against the archdiocese, therefore, has been settled, but the cases are not done because other liable parties named in the lawsuits have yet to pay or their cases adjudicated. That includes the 75 from Guam who sued the Boy Scouts of America in the same lawsuit. The reason BSA was included in the clergy sex abuse case was because for decades clergy who abused boys in Guam abused the boys during scout outings and the BSA allegedly actively helped to cover up the crimes.

As the Guam claimants’ cases had been moving forward, other cases throughout the country also went through their respective jurisdictions’ courts. That is, until the BSA filed for bankruptcy in Delaware in February 2020. At that time, Guam’s 75 claimants accounted for one quarter of all claims nationally. Then, by the bar date for claims, the total rose to more than 82,000.

The Delaware court approved a settlement plan in September 2022 to pay the 82,000 claimants from BSA assets and release 250 local Boy Scouts councils and more than 100,000 organizations that have been included in BSA co-insurance policies since 1976. These include insurance companies, American Legion chapters, police departments, and churches associated with the Boy Scouts chapters. None of these organizations were party to the bankruptcy, yet received the protections of bankruptcy in the BSA bankruptcy case. Ms Wolff and her clients immediately objected to the settlement and for two years litigated in Delaware and then on appeal to the Third Circuit. Both courts denied Ms. Wolff’s applications for stays.

In the midst of the court battle, the Purdue settlement case reached the U.S. Supreme Court, and Ms. Wolff pointed to it and its striking similarity to the questions she has raised on appeal. On April 19 last year, Ms. Wolff’s application for stay was denied by the Third Circuit, and one hour later, BSA began to implement the settlement plan.

With the start of its implementation, nearly all hope was lost that any of the 82,000 claimants against BSA would be able to receive compensation from more than 100,000 entities with billions in combined assets. And then Mr. Alito did what is believed to be unprecedented: he stayed the further implementation of the settlement plan already in motion, with court observers believing the stay has everything to do with a decision by the Supreme Court expected any day now on the Purdue Pharma bankruptcy settlement case.

Just like the BSA case, the bankruptcy court in Purdue released nonmoving debtors from liability to pay the victim claimants of the opioid crisis Purdue is accused of creating throughout the country through its marketing of its highly addictive narcotic Oxycontin. Among those nonmoving debtors was Purdue’s owners, members of the multibillionaire Sackler family. The Sacklers did not file bankruptcy, and so their assets were never discovered for the purposes of the Purdue bankruptcy case, yet that bankruptcy court approved a settlement plan where the Sackler family would pay $6 billion over a 1o year period and be released from any further lawsuit on the matter. The victim claimants did not agree to that, as the particular bankruptcy case to determine that settlement was against Purdue, not the Sacklers.

The Justice Department’s U.S. Trustee in the Purdue case raised objections to the Purdue settlement, which paved the way for December 2023 arguments before the U.S. Supreme Court. Several reports about that day state the Justices had questions that were far ranging and outside the scope of the appeal. The question in that case is the same question Lujan raises:

“Whether the Bankruptcy Code authorizes a court to approve, as part of a plan of reorganization under Chapter 11 of the Bankruptcy Code, a release that extinguishes claims held by nondebtors against nondebtor third parties, without the claimants’ consent.” (In re Purdue Pharma LP et al., Case Number 22-110 (2nd Cir. 2023)

The significant difference is that unlike the Purdue settlement, BSA already began making distributions according to the now-stayed settlement plan. The mid-execution of the plan normally would have rendered the question moot, according to several law firms throughout the nation that have published reports about the February 16, 2024 stay by Mr. Alito. The fact that the high court did not reject the Lujan case question in BSA is itself unique, with the eyes of corporate America glued to the matter.

Both the Purdue and the Lujan cases are considered by court observers to be the most-watched and highly anticipated court decisions on bankruptcy in decades. The decision in either one – as they are cases with nearly identical questions for the court at hand – may redefine bankruptcy and may affect billions in economic activity throughout the nation, according to several reputable news sources on the issue.

For Ms. Wolff, the issue in her pleadings is about the 75 clergy abuse survivors she represents in the BSA case, and their ability to go after everyone else associated with the BSA who is a debtor to her clients. Her dogged representation of those 75, however, may be what opens the door to 82,000 others throughout the country to go after the more-than 100,000 debtors that the now-stayed settlement plan immunized from liability.

The high court is expected to issue a ruling in the Purdue case any time before the end of June.