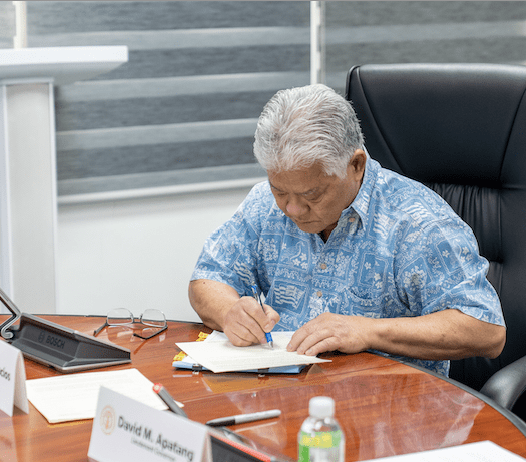

Nice try in the effort to escape fiscal responsibility for the financial mess Ralph Torres left behind, the CNMI governor wrote in a stern budget message to the senate president and the house speaker. But the only way the Commonwealth government will survive Fiscal Year 2024 is if the legislature stops delaying the inevitable tough decisions that need to be made. That was the crux of Arnold Palacios’ message to Edith Deleon Guerrero and Edmund Villagomez as he signed the FY 2024 budget into law Saturday, averting a shutdown at the start of the fiscal year, October 1, 2023.

And with every day the legislature delays the raising of revenues through several tax increases, the burden upon the people becomes higher as the bills compound into a fiscal year that grows smaller with every day that passes.

The budget the legislature gave the governor fails to fund almost all of the $31 million needed for the government’s health insurance program, the bulk of the $13 million needed to fully fund Medicaid for the impoverished and the working poor, utilities payments for the government, the medical referral program, and the 25 percent pension payment to retirees.

The legislature employed a mathematically-flawed political ruse to appear to the public as though it had passed a responsible budget by giving the governor 100 percent reprogramming authority. In other words, the legislature has allowed the governor to move funds from one area of the budget to fund shortfalls in other areas. That authority, however, is restricted to only certain accounts.

The governor, in his budget letter, called out the ruse.

“The Act offers the flawed solution of punting the obligation to the executive branch to use the 100% reprogramming authorized in this Act. The reprogramming only works if there is sufficient funding available to meet the already anticipated shortfalls. Such funding has not been appropriated to the executive branch in this skeletal budget with only the estimated sum of $500,000 available for reprogramming. Punting obligations down field or throwing Hail Mary passes hoping for miracles is not the responsible approach to budgeting when lawmakers knowingly approve a spending plan that is not adequately funded.”

The legislature’s budget reconciling conference committee, however, did report two weeks ago that it recognizes the shortfalls and will work on bills to raise various taxes.

“[T]he Conferees agreed to jointly push forward with tax bills because at this point, there is no other stream of revenue that can address the government’s revenue shortfall except for tax hikes,” the committee report to both houses states. “Several tax bills that garnered the Conferees support include the tobacco tax increase; sugar sweetened beverage tax; container tax; betel nut tax; and pending further review of its language, the construction tax.”

The construction tax is anticipated to provide the greatest amount of revenue. It also is anticipated to cause the greatest strain on economic development and an increase in prices.

While the legislators are hopeful, none could provide any empirical evidence these tax increases will fully fund the GHLI and Medicaid shortfalls. So, they had to resort to two more budgetary cuts and maneuvers.

“I would like to ask the legislature to fast track the revenue legislation that have already been proposed,” Mr. Palacios said at the Saturday news conference, where he signed the budget with reservations. “That will address, at least it will generate a significant amount of revenue that will address some of the shortfall of the government.”

Mr. Palacios, in his budget message, also pointed out the disparity in cuts the legislature made, with the executive branch understandably bearing the brunt of operational funding cuts to the tune of a 64 percent slash. The legislature, however, cut its operational funding by only less than half of one percent.

The governor also line item vetoed the following from the budget:

- Section 601, which would have required the governor to cover the utilities expenditure shortfalls of the courts, the legislature, and the municipal governments.

- Several sections mandating additional reporting requirements. The governor’s reasons ranged from duplicative language in existing law to a lack of resources within the Department of Finance to perform the additional tasks.

- Section 707, which would have dumped the obligation of the mayor of Tinian to fund 24 of his employees onto the central government.

- The annualized 70-hour workweek has been vetoed. Section 605, which adjusted downward the rates of pay for legal holidays was line-item vetoed, effectively deleting the so-called 70-hour work week.

- Section 703, which would have dictated the release of cash disbursements to the courts, a clear violation of the constitutional separation of powers.

- Language that would have mandated the funding of stipends, airfare, and lodging in the medical referral program. Mr. Palacios said the mandate would have been an unfunded, empty promise.

“My administration stands ready to work with the Legislature to iron out our differences and work collectively and cooperatively to address the government’s fiscal challenges,” Mr. Palacios wrote in his budget message.

The budget now is Public Law No. 23-09.