The Commonwealth Legislature needs to raise several taxes and further cut pay for government employees in order to fund Medicaid for the poor and group health and life insurance for employees. And even if these are fully funded, several other programs and agencies will not have enough money to operate fully in the upcoming fiscal year. These are the financial realities of a government healing from the obliteration of fiscal resources through the reign of Ralph Torres and the tremendous deficit he left behind.

And while Mr. Torres no longer is in office, remnants of his regime who continue in power have managed to prioritize disputed funding to the mayor of Tinian at the expense of funds needed to keep the Northern Marianas College afloat through Fiscal Year 2024.

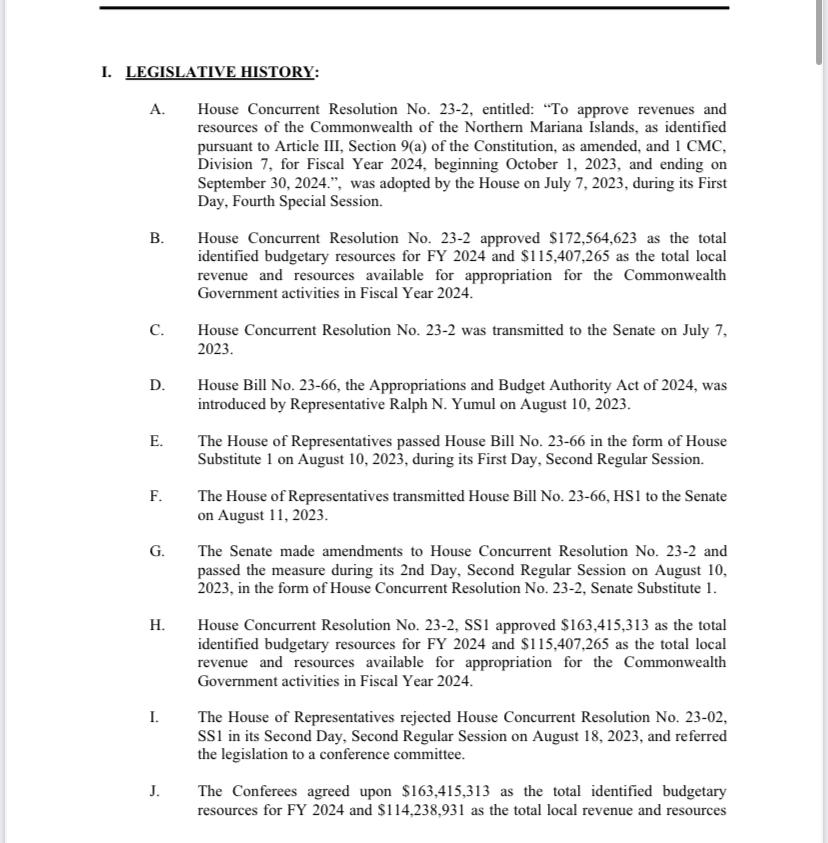

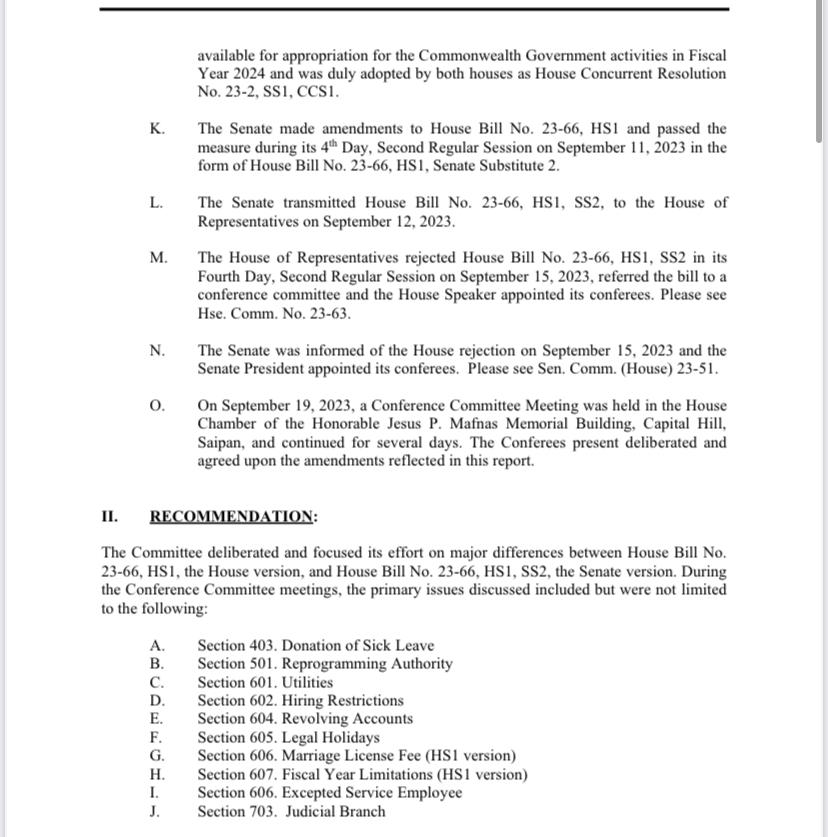

That fiscal year begins October 1, 2023, and only will be funded if both the House and the Senate approve a budget reconciled Saturday by a conference committee that ironed out differences between the two houses of the legislature. The governor also must sign whatever budget he receives from the legislature by September 30 in order to avert a government shut down.

Sources tell Kandit that Arnold Palacios may be using his line item veto authority to eliminate budgetary and administrative provisions he does not view as priorities in an era of austerity.

Shortfall in GHLI and Medicaid reimbursement funding

The substitute budget by the conference committee leaves behind two critical programs:

About $31 million needed to fund the cost of health and life insurance coverage for government employees, retirees, and their dependents; and

The bulk of $13 million the Commonwealth government needs to pay the U.S. Department of Health and Human Services in order for people on Medicaid to have health coverage through the majority-federally funded program. The governor proposed to fund this reimbursement at $7 million, but the legislature nearly zeroed out the earmark.

In Mr. Palacios’ budget submission, the governor identified $6 million in local funds to help defray the $31 million cost of the annual group health and life insurance (GHLI). The legislature instead cut that earmark to only $70,000. The major funding factor was an error the administration made, when it included about $9 million in new revenue in its budget submission.

That $9 million in new revenue would have been from a proposed increase in the business gross receipts tax, which the governor included in his budget proposal. Legislators, taking advice from their attorneys, concluded the revenue could not be recognized in the new budget without the tax increase occurring first through separate statute.

The earmark shortfall also affected the amount Mr. Palacios proposed for the Medicaid reimbursement. Legislators did not propose any solution to cover the shortfall in the budget itself.

Agreement to increase several taxes

To push through an impasse and avert a shutdown, the members of the conference committee, called ‘Conferees,’ instead agreed to support legislation in their respective houses to increase several taxes.

“[T]he Conferees agreed to jointly push forward with tax bills because at this point, there is no other stream of revenue that can address the government’s revenue shortfall except for tax hikes,” the committee report to both houses states. “Several tax bills that garnered the Conferees support include the tobacco tax increase; sugar sweetened beverage tax; container tax; betel nut tax; and pending further review of its language, the construction tax.”

The construction tax is anticipated to provide the greatest amount of revenue. It also is anticipated to cause the greatest strain on economic development and an increase in prices.

While the legislators are hopeful, none could provide any empirical evidence these tax increases will fully fund the GHLI and Medicaid shortfalls. So, they had to resort to two more budgetary cuts and maneuvers.

Pay cuts for most employees

According to the proposed substitute budget, employees funded under the budgetary units will realize further cuts in pay that will amount to a 70-hour work period, when annualized. This will not be in the form of an additional two-hour payout every two weeks on top of the existing eight-hour pay cut (austerity Mondays).

The legislators instead have given the governor the authority to declare five locally-funded holidays to be unpaid days off. For those essential employees who must work on these holidays, they no longer will receive holiday pay of time-and-a-half, but straight time. The legislature anticipates this will save $1.7 million in FY 2024.

The proposal will affect the legislature and the courts as well.

The Tinian dispute and the sacrifice of NMC funds

Mr. Palacios’ original budget zeroed out a $2.2 million request from the Tinian Municipal Government. The basis of this was the governor’s contention that Edwin Aldan received millions in funding for operations of his government from federal pandemic funds shortly before Mr. Torres left office.

The governor and members of the legislature have asked Mr. Aldan to produce financial documents indicating how those monies have been spent, if Mr. Aldan’s contention is that he no longer has money to pay 97 employees through FY 2024. The $2.2 million budget request largely is to pay those salaries.

Mr. Aldan had threatened to furlough those employees if his government did not receive the funds from the central government for the new fiscal year. The House version of the budget largely abided by Mr. Palacios’ request. The Senate, however, deviated without demanding proof from Mr. Aldan about its expenditures.

The controversy ended in the conference committee with a compromise. Mr. Aldan reportedly has agreed to transfer $500,000 from the funds he received from Mr. Torres to the secretary of finance to pay for 24 of the 97 employees’ salaries. The conference committee substitute budget uses local funds to pay for the remaining $1.7 million request, making the Tinian budget request one of the rare funding units made whole by the legislature’s budget.

That $1.7 million was taken from the funding needed for Northern Marianas College, which by statute (Public Law 13-31) is supposed to be budgeted at least $6 million every fiscal year. NMC, according to the substitute budget, will only receive about $4 million.

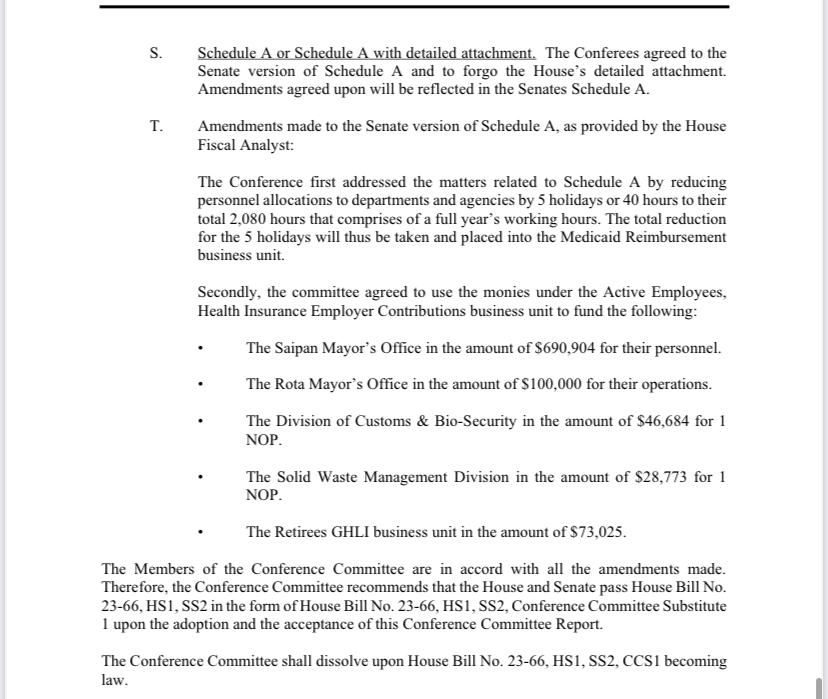

You may review the other significant budget agreements from the conference committee in the report that follows.

1 Comments

Russ Mason

09/25/2023 at 12:08 PM

Lets not overlook bake sales and carwashes, Gov. It would be quite a treat to see members of the legislature with soapy rags and hoses finally doing something beside pontificating.

I also heard that Celene Babauta makes a terrific sponge cake. And Ed Villagomez makes cupcakes to die for.