Vice Speaker Tina Muna Barnes introduced legislation Thursday that will cut and restore the business privilege tax to its pre-2018 level of four percent of gross receipts. Since the Guam Legislature already cut the BPT for businesses with annual gross revenue of $500,000 or less to three percent, this Bill No. 70-37 will affect the remaining 10 percent of Guam companies grossing revenue above that threshold.

Those companies are the largest employers on the island, and have the financial wherewithal to provide group health insurance coverage to their employees. A condition of the tax cut, according to Ms. Muna Barnes’s legislation is that these companies would have to provide health insurance coverage for their employees at minimum standards to be adopted by the Guam Department of Revenue and Taxation.

The majority of senators, including two republicans, signed onto the bill as sponsors.

A news release from Ms. Muna Barnes on her legislation follows:

A healthy economy needs a healthy community, this is why Vice Speaker Tina Muña Barnes and 8 of her colleagues introduced Bill no. 70-37 today. The measure proposes to lower the Business Privilege Tax to 4% for businesses who are not eligible for the Dave Santos waiver. With the impending military buildup, and the shortage of workers across all industries on Guam, this measure proposes to allow employers to provide a more competitive benefit package while providing some mechanism to offset the added cost. In turn, by providing health insurance to employees, this bill also hopes to offset the government cost for programs such as MIP and Medicaid.

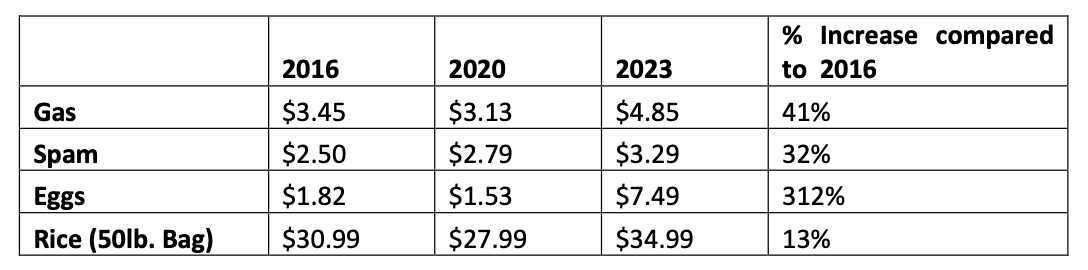

While reducing the BPT for large businesses may have an impact on government revenues, Mr. Gary Hiles, the Chief Economist for the Government of Guam testified for a separate measure earlier this week that inflation has actually helped generate revenue for the Government of Guam. The rising costs of goods on Guam has allowed for the Government of Guam to collect Business Privilege Taxes from higher dollar amounts.

“While we wholeheartedly support a 22% increase to our hardworking Government of Guam employees, we must do so in a way that does not negatively impact the private sector as their success funds the Government of Guam” stated Vice Speaker Muña Barnes. She adds “I know firsthand the difference health insurance makes when a loved one desperately needs it. Bill 70-37 puts our People first and hopes to find a middle ground that I believe will provide a small relief to the private sector. I hope this begins a fruitful exchange amongst our community; I thank my 8 colleagues who took the time to hear me out and work alongside me.”