“IPI ready to transfer license and leave NMI,” the Marianas Variety announced in its March 4 headline. I thought it was my FALCONS flying overhead, but actually, it was the sound of this proposed deal going WHOOSH over Emmanuel Erediano’s head! So despite my having been in retirement for well-nigh a century, I have to put on my Jessica Fletcher HAT AND SCARF and do the detective work that journalists are supposed to do.

Here’s what’s important (in my opinion, as I’m an OPINION COLUMNIST): IPI wants to delay the revocation by promising a pie-in-the-sky payment that will never materialize but will set back the revocation a few more years, while the big boys (and girl) back in China desperately try to unload their shares on hapless mom and pop investors. Meanwhile, the amount owed will be reduced from $80 million to $47 million, and $47 million, not $80 million, will be the figure discussed the next time they’re brought up to kangaroo court for not paying up. What an easy way to save $33 million! I wish SAIPAN SELECT had coupons like that!

Now IPI claims to have secured a $300 million investment. That’s twice what two years ago they claimed to be receiving from a “Korean investor” who showed up in Saipan in a white linen suit, Jackie O sunglasses, and a ponytail mullet. That is absolutely NOT how gangsters dress in Korea. It absolutely ISN’T.

(By the way, Marianas Variety reported that supposed $150 million deal as fact: Emmanuel Erediano, July 25, 2022, “IH Group ‘carefully reviewing’ IPI deal.” And then, like goldfish, they never followed up or mentioned that ultimately there was no deal.)

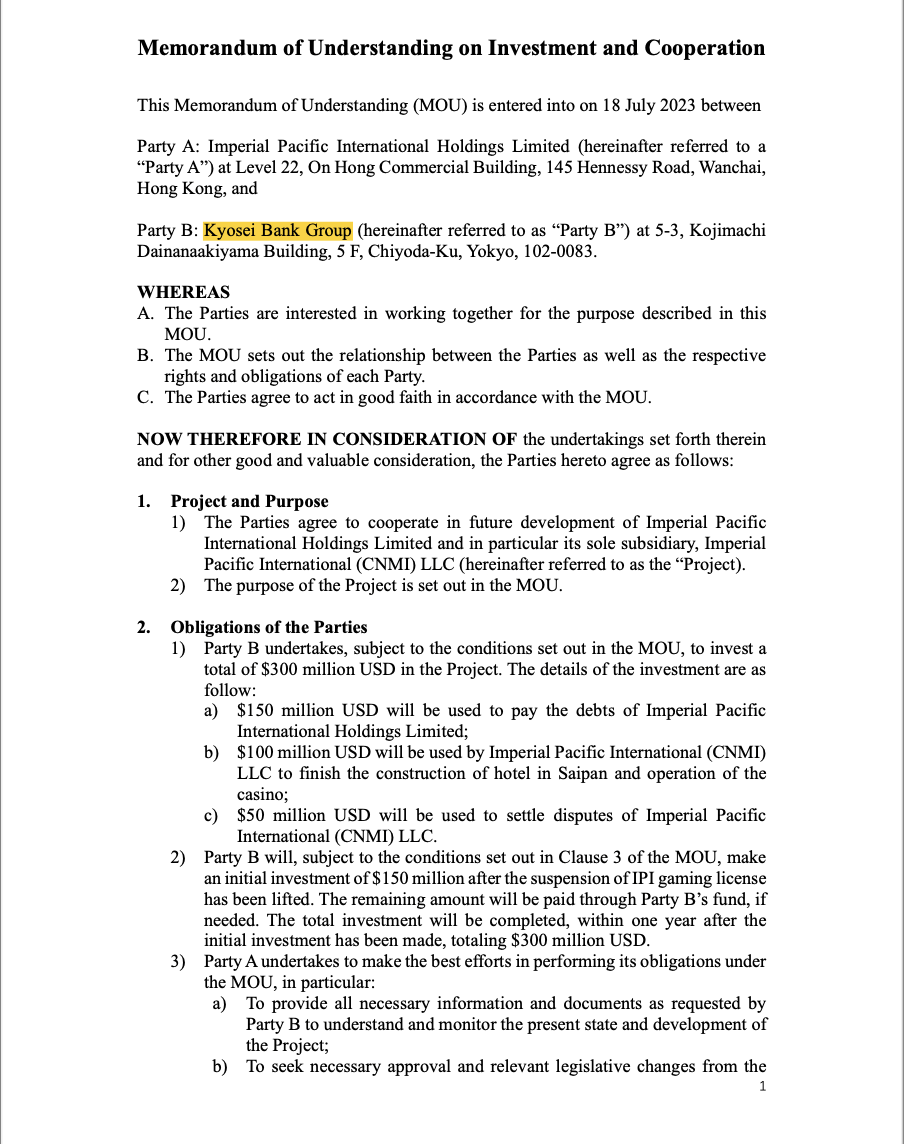

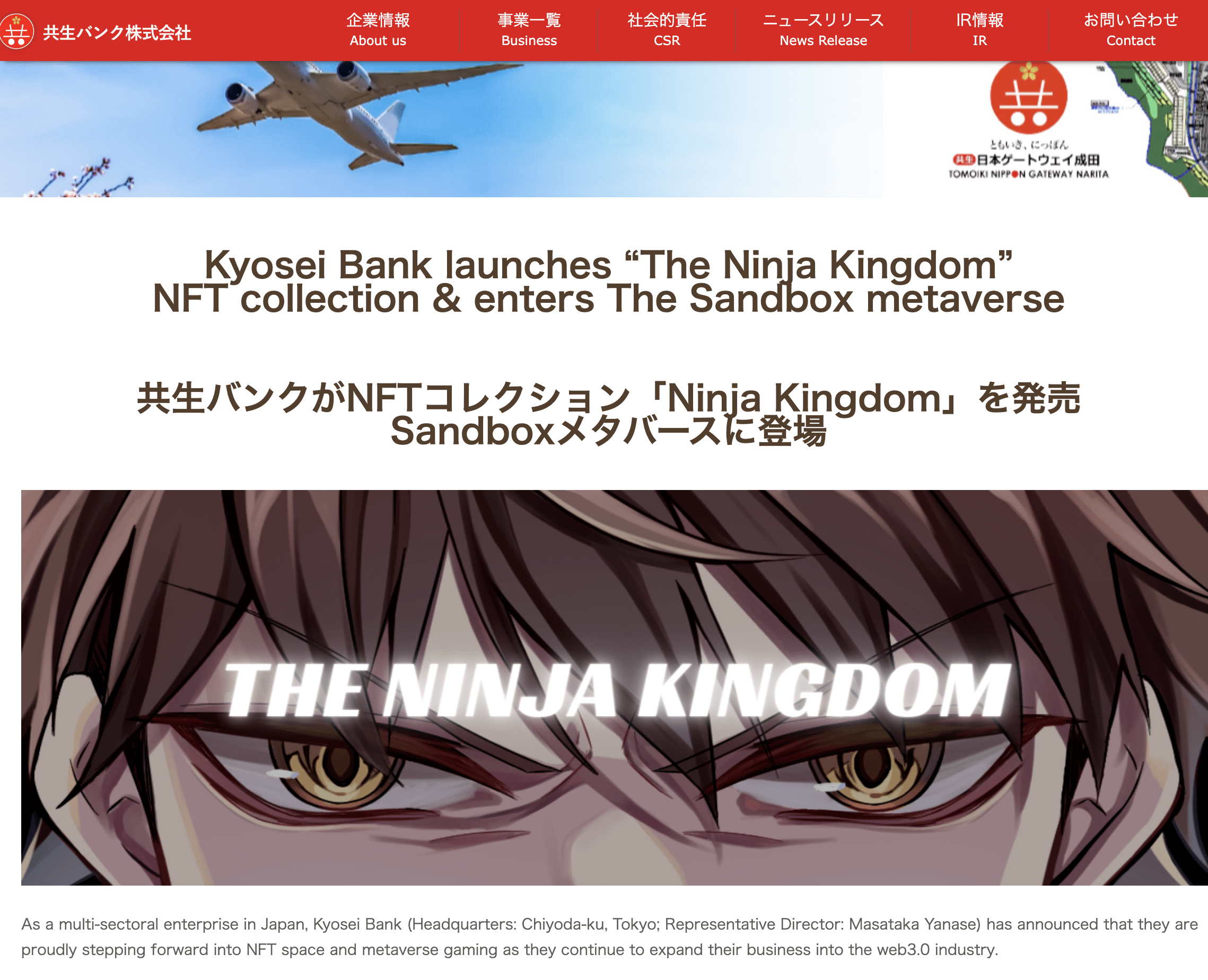

This time around, the “investor” named in IPI’s current federal court filing (Exhibit 12) is “Kyosei Bank Group.” Except there is no such entity as Kyosei Bank Group. There is, however, something called Kyosei Bank, which seems to have a business of flipping shady (in my opinion!) bankrupt Chinese companies, plus selling NFTs!

https://news.futunn.com/en/

https://www.kyosei-bank.co.jp/

Well, who cares about getting the name right — it’s just $300 million!

Have you ever seen a $300 million deal based on a document where

-

Tokyo is spelled Yokyo

-

Kyosei Bank Group doesn’t exist, but maybe they mean Kyosei Bank? Who knows!

-

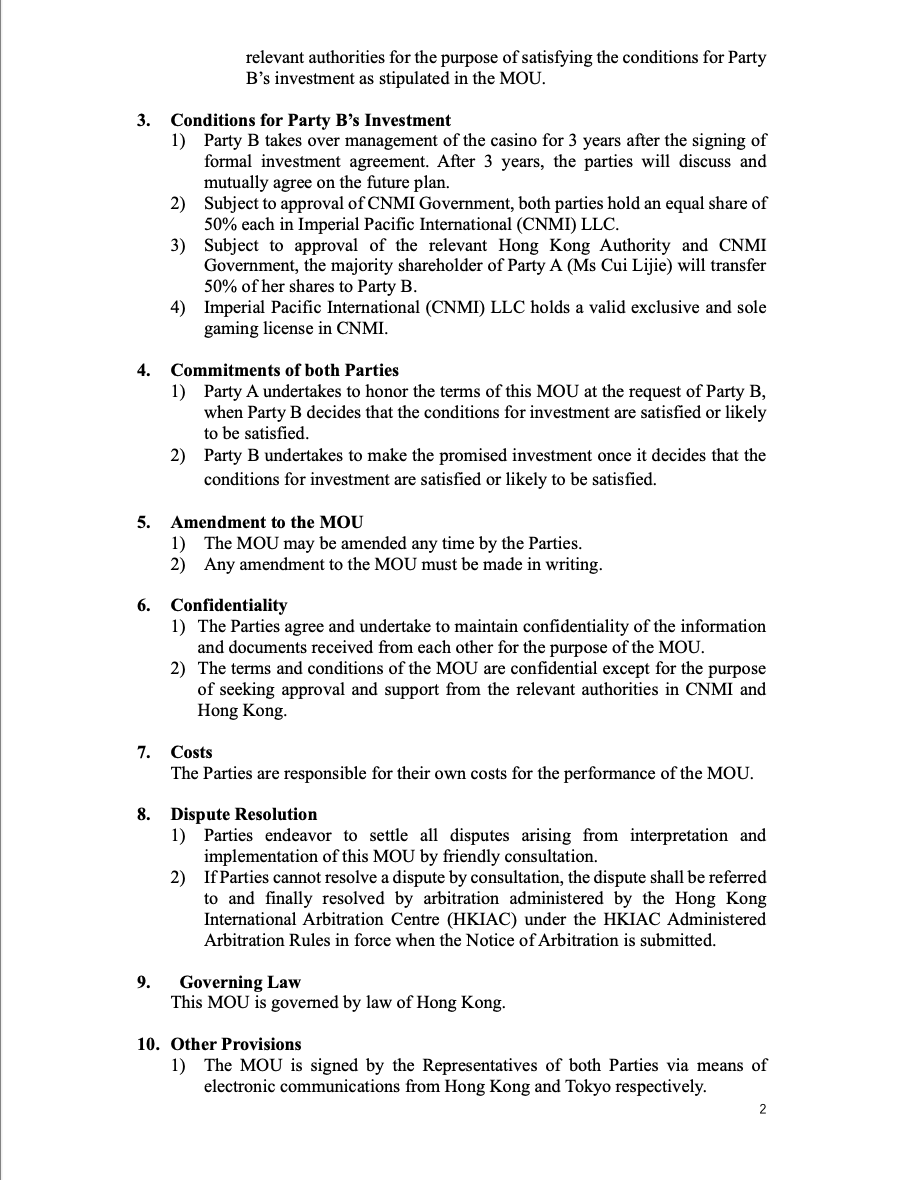

The document is a MOU, not a contract, so by definition not legally enforceable

-

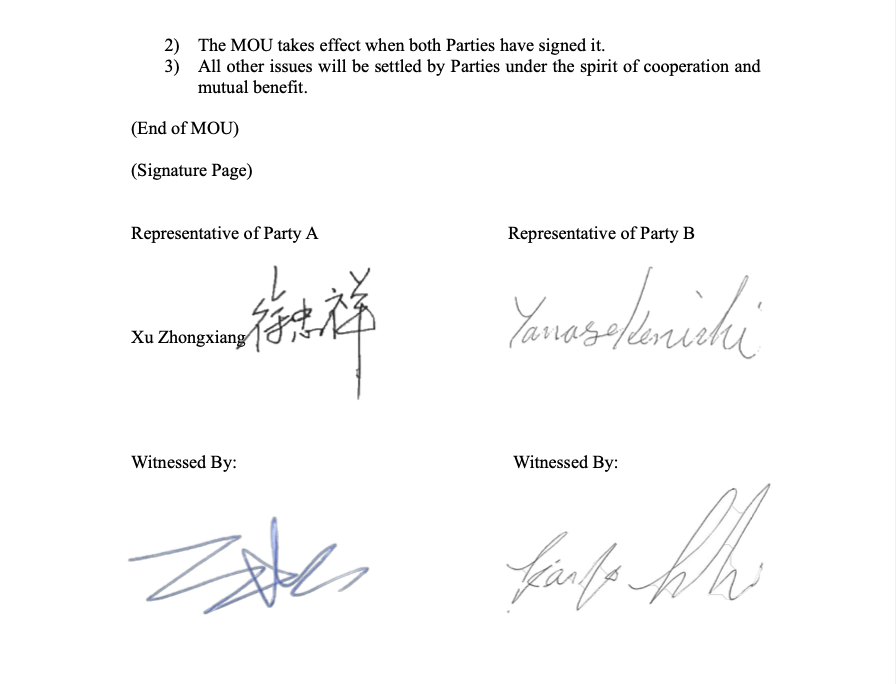

The “representative of party B” doesn’t give their name, and neither do the witnesses.

Maybe you haven’t seen any $300 million deals, but having had quite a bit of work done on my face and my buttocks, I certainly have! And the paper shown in Exhibit 12 resembles, in my professional opinion, the documentation for buying a dog. No offense to dogs.

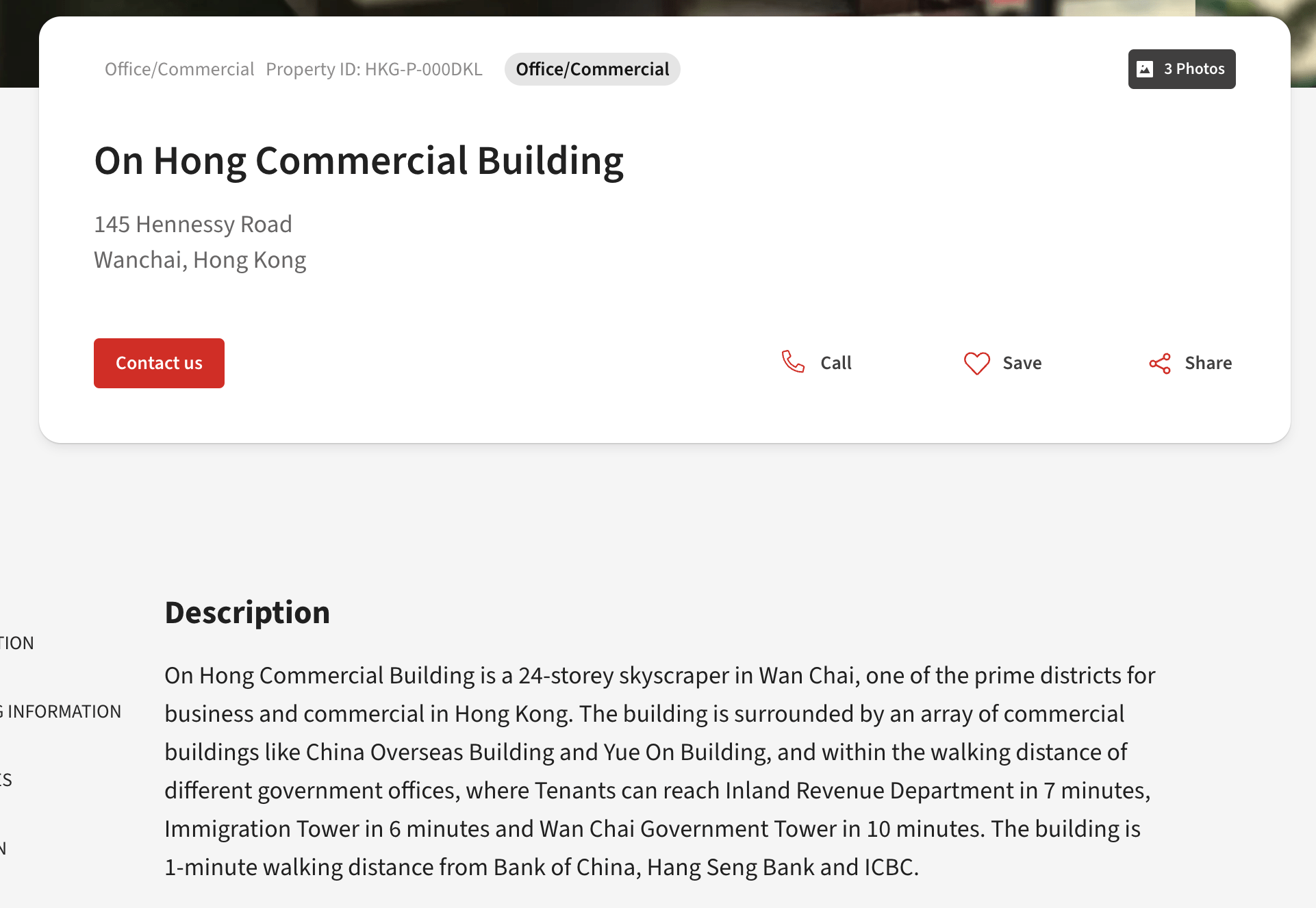

The usual documentation for a $3 million deal is going to be about a hundred times more elaborate and professional than this MOU supposedly for $300 million. This MOU reads like something drawn up late at night in a shabby Wanchai office building by someone desperately trying not to upset the big bosses.

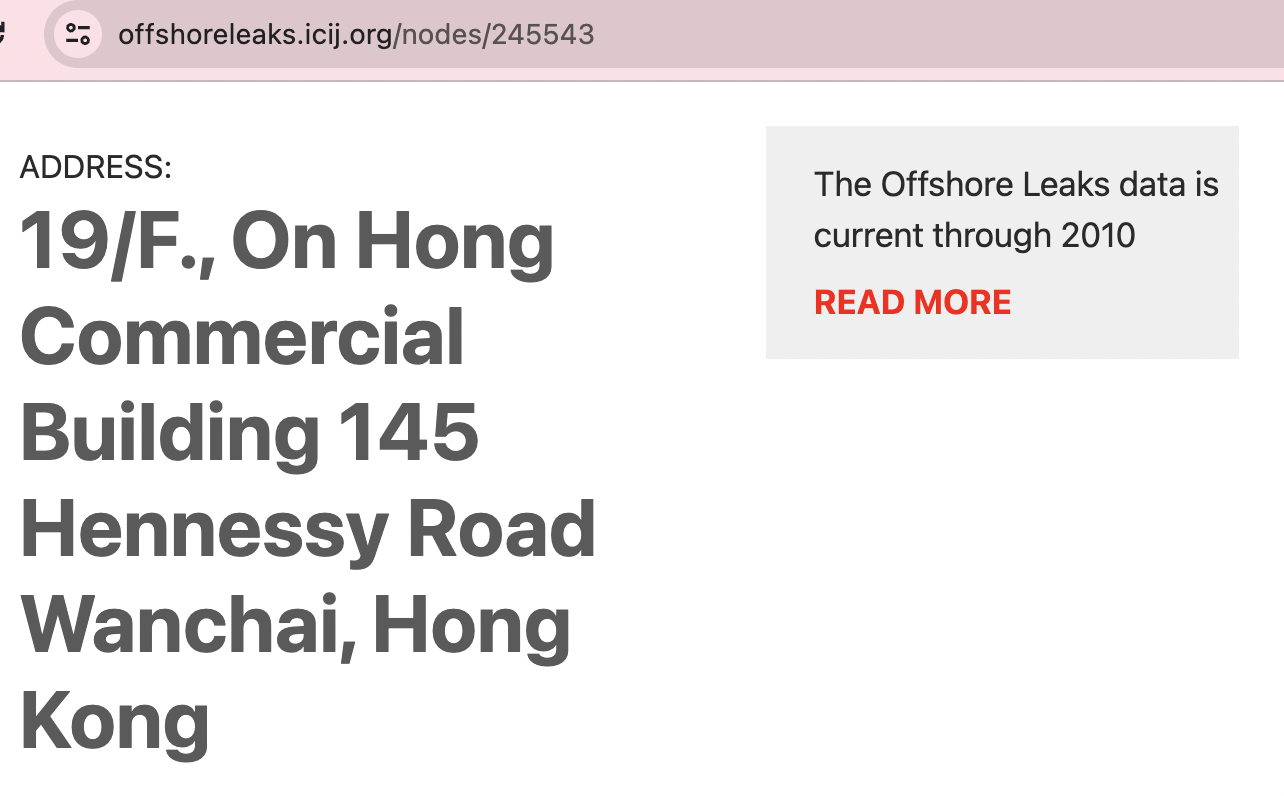

Wait, what’s that just in from the telegraph? IPI’s headquarters is in a shabby Wanchai office building?

Well that looks like a good office for a fake Rolex dealer or an unlicensed dentist. And it’s in Wanchai, Hong Kong’s red-light district!

And they’re just three floors above an office in the Offshore Leaks Database that lists potential money launderers:

https://offshoreleaks.icij.

What a coincidence!

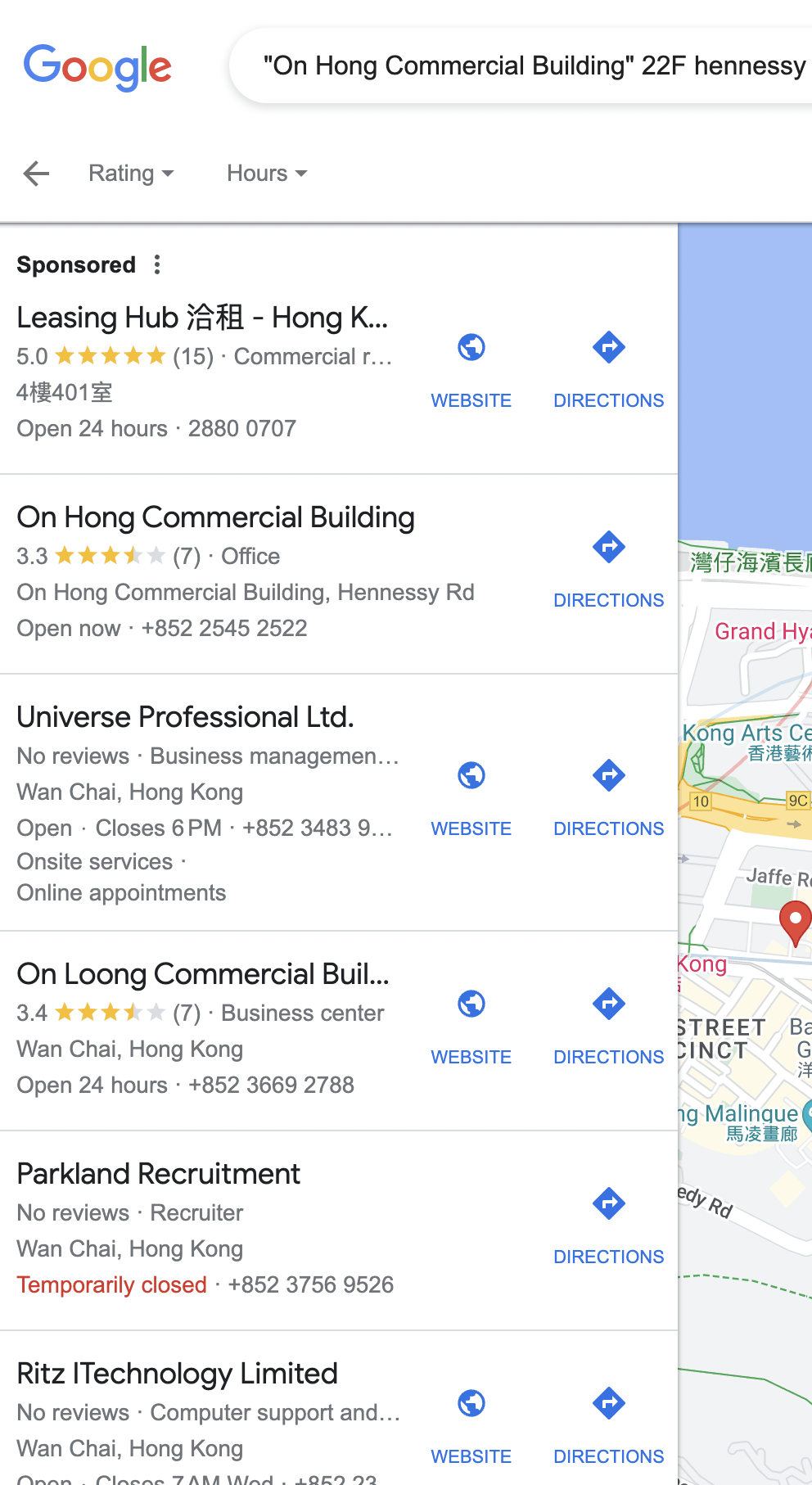

But it must be a crowded office, because look at all the other companies that share IPI’s office space (not just the building, but the actual office):

But it must be a crowded office, because look at all the other companies that share IPI’s office space (not just the building, but the actual office):

https://www.google.com/search?

CB Group Outdoor Furniture, Gatehouse International Freight, Pacific Palette International, Epochsoft Consultants, and so many more! What a crowded office!

Kyosei’s building isn’t much better. Sure looks like a building where $300 million just crosses the desk, ho hum, no big deal:

https://officee.jp/en/catalog/

But let’s go back to the supposed MOU! The key points of a contract are who, what, why, and WHEN. So WHEN will this supposed $300 million investment happen? The MOU itself says, “Party B undertakes to make the promised investment once it decides that the conditions for investment are satisfied or likely to be satisfied” — what my paramour Johnny Mathis calls THE TWELFTH OF NEVER.

There’s even the reassuring followup: “The MOU may be amended any time by the Parties.” That certainly sounds like a real contract for $300 million.

In my opinion, there is absolutely zero chance that this “Kyosei” deal is real. And all that’s happening here is delaying the license revocation for another year or two while there are “delays in funding.” Meanwhile, the baseline for the amount owed will be halved — so you can bet (get it, bet?!) that at the next revocation hearing, in 2026 or whatever, the starting amount will be $47 million, not $80 million.

So where’s the newspapers’ analysis of all this? Yet again, they just take everything and print it as fact? Maybe they’ll print their incisive analysis on the twelfth of never. Meanwhile, IPI is sitting back and laughing at us.

_____

Mabel Doge Luhan is a woman of loose morals. She resides in Kagman V, where she pursues her passions of crocheting, beatboxing, and falconry.